© 2018 Zhangjiagang YUSHENG MachineryAll rights reserved. Site Map Designed by iwonder.cn

Trade Balance

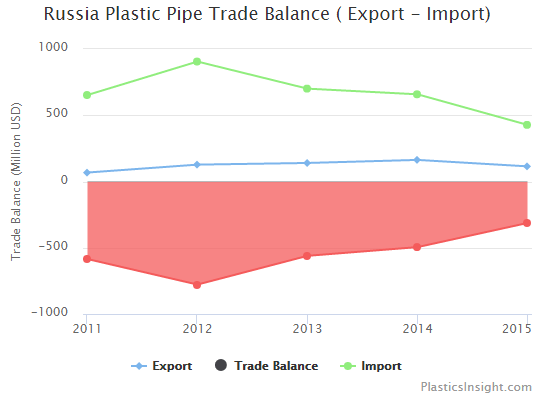

Plastic pipe & fitting market in Russia is growing for many years. The major end-use segment of plastic pipe & fitting is water pipes, sewage & gas pipe. The Trade Balance (Export – Import) for Plastic Pipe & Fitting market is negative. Russia is importing more than what it is exporting. The trade balance in 2015 was $313 million. Russia exported $114 million worth of plastic pipe & fitting but imported $427 million worth of the product.

As shown, the import for pipe & fitting is decreasing from past few years. It is because of negative factors such as a high price of Polyethylene in the international market, currency fluctuation, the decrease in buying activities and government focus on import substitution.

Plastic pipe & fitting market remains import dependent. Import is also prevalent in fittings segment as no major domestic company is manufacturing electro-welded & alloy fitting which remains the major importing products. Plastics Pipe Industry in Russia is import depended because of the shortage of pipe grade raw material and not sufficient domestic capacities to meet the local demand. The country has to rely on import because another deterrent factor for local capacities to develop is that the cost of production locally at present is quite high than overseas.

Import Share By Material

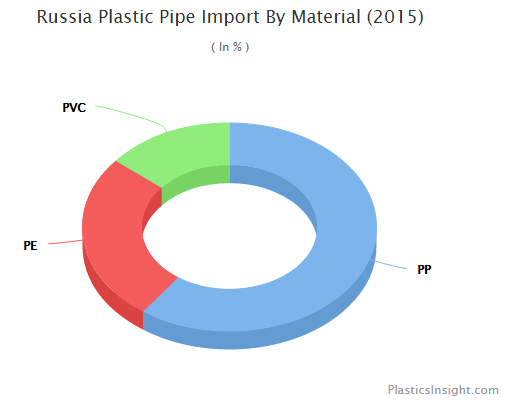

Polypropylene plastic pipes are more in demand because of its functional advantage than the other competing pipe. Propylene pipes are higher in demand for sewer and drainage systems in non-pressure corrugated pipe segment. While polyethylene pipe is more in demand for outdoor drainage system because of its flexibility to have larger size diameter. They are relatively more cost effective in production than other competing pipe materials.

In 2015, the major share of import was of polypropylene pipe. They occupied almost 60% share market of plastic pipe import. They polyethylene pipe had 26% of market share in the total import of plastic pipe in 2015 while poly vinyl chloride (PVC) occupied 14% of the market share.

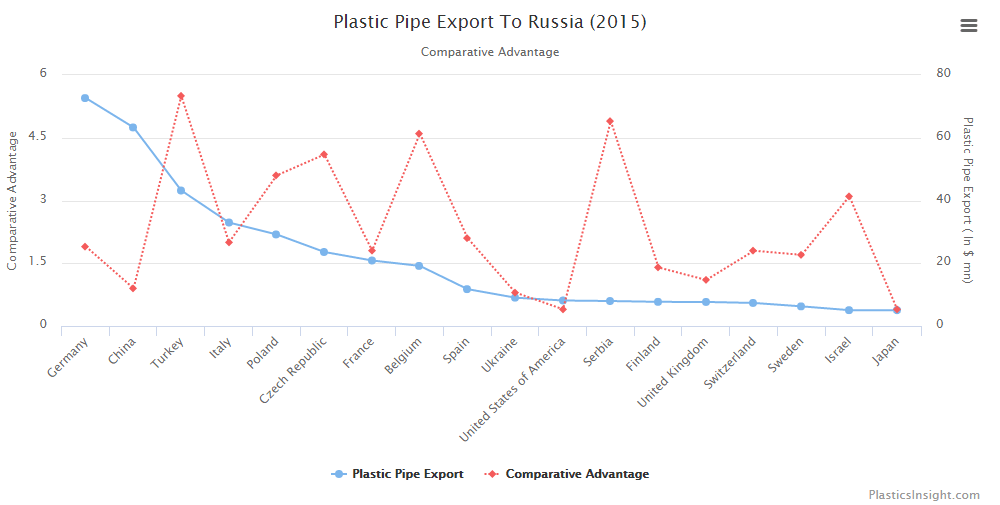

Plastics Insight has analyzed the plastics pipe export market of Russia for comparative advantage for exporting. As shown above in graph, the higher the number value (in red color) of a country the easier it is for that country to export plastics pipe & fitting to Russian market than the other competing countries. We see that Turkey (5.5), Serbia (4.9), Belgium (4.6), Czech Republic (4.1) & Poland (3.6) are the top 5 countries have the most advantage in exporting plastics pipe & fitting to Russia market in 2015.

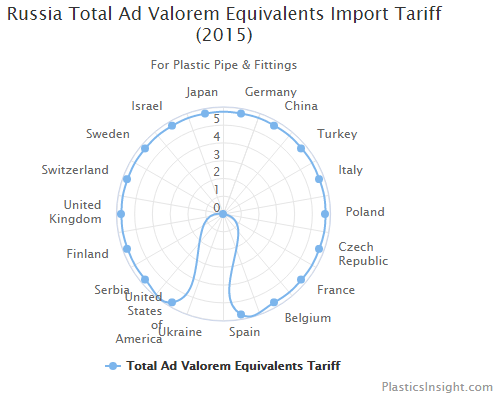

Total Ad Valorem Equivalents Import Tariff

Total ad valorem equivalents import tariff is one of the most important factors in deciding your export strategy. All the countries mentioned in the analysis have an import tariff of 5.74% except Ukraine which has an import tariff of 0% for plastic pipe & fitting to the Russian market.

So,tariff wise only Ukraine has a comparative advantage than rest of the countries which have same import tariff to the Russian market for the product.

Russia Plastic Pipe & Fitting Market Highlight

– Recently the longest PE SDR9 gas pipeline has been commissioned in Russia. The gas pipeline made of PE pipes is almost 130 km, with diameter – 315mm and operating pressure of 1.2 MPa. It connects 18 settlements of Tobolsk and Yarkovskiy regions.

– The start-up of the new line for PE pipes with diameters from 225 mm to 400 mm took place at SIBGAZAPPARAT plant in Tyumen on 10 April 2014. The line will produce long-expected 355 mm PE 100 SDR 17–26 pipes that are in great demand.

Market Opportunity

– Due to outdated communal infrastructure where more than half of the outdated utilities need immediate replacement provide an excellent opportunity for plastic pipes.

– Russia & CIS countries have 470 thousand km. the length of heating supply networks. Though this segment is declining but it still provides a tremendous market potential for district heating pipe projects.

– High margin segment of plastic fittings present an attractive opportunity. Major Russian players do not manufacture fitting and are primarily importing to cater the market. This segment provide ample space for an exporter to enter the market.